If you believe the passive investing enthusiasts, at this years Berkshire Hathaway AGM Warren Buffett spent half the meeting extolling the virtues of index investing and berating hedge fund manager fee structures. Great comments include

"If you go to a dentist, if you hire a plumber, in all the professions, there is value added by the professionals as a group compared to doing it yourself or just randomly picking laymen. In the investment world it isn't true. The active group, the people that are professionals in aggregate, are not, cannot, do better than the aggregate of the people who just sit tight."

At first glance one could observe that Mr Buffett is possibly overlooking some of his primary investing tenants.

From Jesse Felder, ‘The Four Most Dangerous Words In Investing’

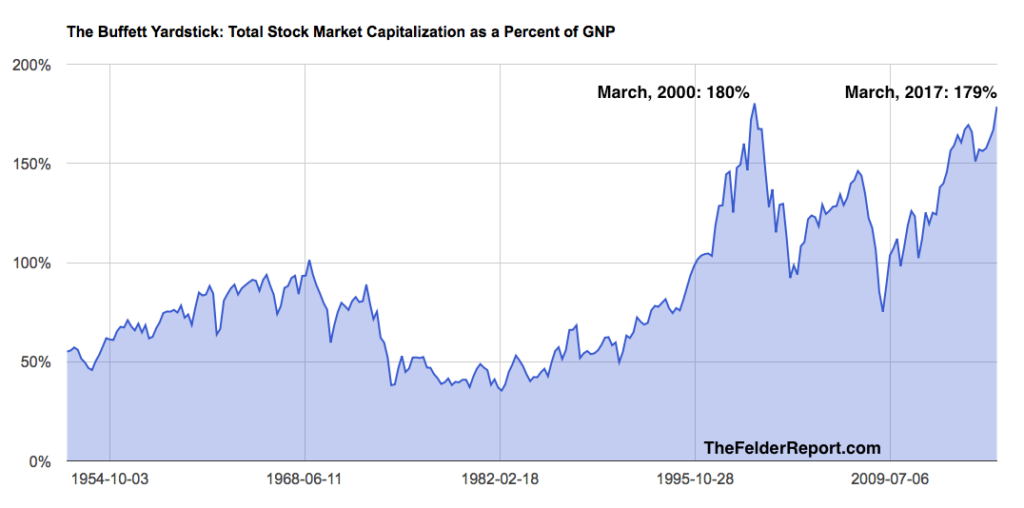

Warren Buffett has famously said many times, “the price you pay determines your rate of return.” Additionally, he wrote back in 2001 the best measure of equity valuations was total stock market capitalization as a percentage of GNP: “For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000–you are playing with fire.”

Among other great Buffett quotes that a current index investment in the US seemingly ignores (while the CAPE ration is in the high 20's), is that there is no "demanding of a margin of safety” or "waiting for a fat pitch”.

Who are we to guess Mr Buffett's thoughts, however his logic in ignoring his value thesis could also stem from the "interest rates will be lower for longer" idea. This will inevitably justify the idea that stocks are't expensive in a low interest rate environment.

However we shouldn't mistake Buffett’s comments about the business of investing for his views on the activity of investing. Buffett’s recommendation to invest passively isn’t because it’s impossible to beat the market (although he acknowledges that it’s become harder). Rather, he believes that the activity of investing can still be rewarding for those with the right temperament.

Buffett doesn’t advise people to invest passively because the market is efficient, or any of the other reasons we’ve considered. He simply recognises that most people don’t have the time, knowledge or temperament to invest actively.